B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

A $15 credit to Sales was posted as a $150 credit. By what amount is the Sales account in error?

A) $150 understated.

B) $135 overstated.

C) $150 overstated.

D) $15 understated.

E) $135 understated.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the account below that impacts the equity of a business:

A) Utilities Expense

B) Accounts Payable

C) Accounts Receivable

D) Cash

E) Unearned Revenue

G) A) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Willow Rentals purchased office supplies on credit. The general journal entry made by Willow Rentals will include a:

A) Debit to Accounts Payable.

B) Debit to Accounts Receivable.

C) Credit to Cash.

D) Credit to Accounts Payable.

E) Credit to Common Stock.

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the accounts that would normally have balances in the debit column of a business's trial balance.

A) Assets and expenses.

B) Assets and revenues.

C) Revenues and expenses.

D) Liabilities and expenses.

E) Liabilities and dividends.

G) All of the above

Correct Answer

verified

Correct Answer

verified

True/False

If insurance coverage for the next two years is paid for in advance, the amount of the payment is debited to an asset account called Prepaid Insurance.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

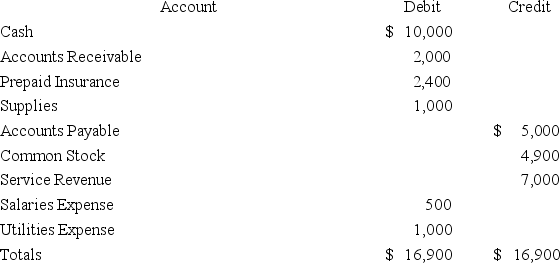

Centurion Co. had the following accounts and balances at December 31:  Using the information in the table, calculate the company's reported net income for the period.

Using the information in the table, calculate the company's reported net income for the period.

A) $1,100.

B) $4,000.

C) $8,500

D) $10,400.

E) $5,500.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

Unearned revenues are classified as liabilities.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is not one of the four steps of processing transactions?

A) Record journal entry.

B) Analyze transactions using the accounting equation.

C) Identify transactions and source documents.

D) Ensure assets are equal to liabilities.

E) Post entry to ledger.

G) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At year-end, a trial balance showed total credits exceeding total debits by $4,950. This difference could have been caused by:

A) An error in the general journal where a $4,950 increase in Accounts Receivable was recorded as an increase in Cash.

B) A net income of $4,950.

C) The balance of $49,500 in Accounts Payable being entered in the trial balance as $4,950.

D) The balance of $5,500 in the Office Equipment account being entered on the trial balance as a debit of $550.

E) An error in the general journal where a $4,950 increase in Accounts Payable was recorded as a decrease in Accounts Payable.

G) D) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the statement below that is true.

A) A trial balance can replace the need for financial statements.

B) The trial balance presents net income for a period of time.

C) Another name for the trial balance is the chart of accounts.

D) The trial balance is a list of all accounts from the ledger with their balances at a point in time.

E) The trial balance is another name for the balance sheet as long as debits balance with credits.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

GreenLawn Co. provides landscaping services to clients. On May 1, a customer paid GreenLawn $60,000 for 6-months services in advance. GreenLawn's general journal entry to record this transaction will include a:

A) Debit to Unearned Revenue for $60,000.

B) Credit to Accounts Receivable for $60,000.

C) Credit to Cash for $60,000.

D) Credit to Unearned Revenue for $60,000.

E) Debit to Accounts Receivable for $60,000.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The debt ratio of Braun is 0.9 and the debt ratio of Kemp is 1.0. Based on this information, an investor can conclude:

A) Kemp finances a relatively lower portion of its assets with liabilities than Braun.

B) Kemp has less financial leverage.

C) Braun has higher financial leverage.

D) Kemp has the exact same dollar amount of total liabilities and total assets.

E) Braun has less equity per dollar of assets than Kemp.

G) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

On January 1 of the current year, Jimmy's Sandwich Company reported total stockholders' equity of $122,500. During the current year, total revenues were $96,000 while total expenses were $85,500. Also, during the current year the company paid $20,000 in dividends. No other changes in equity occurred during the year. The change in total equity during the year was:

A) A decrease of $9,500.

B) An increase of $9,500.

C) An increase of $30,500.

D) A decrease of $30,500.

E) An increase of $73,500.

G) B) and D)

Correct Answer

verified

Correct Answer

verified

Essay

On December 3, the XFL Company paid $1,400 cash in salaries to employees. Prepare the general journal entry to record this transaction.

Correct Answer

verified

Correct Answer

verified

Short Answer

________ documents identify and describe transactions and events entering the accounting system.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Jay's Limo Services paid cash dividends of $100. Which of the following general journal entries will Jay's Limo Services make to record this transaction?

A)

B)

C)

D)

E)

G) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the statement below that is correct:

A) The left side of a T-account is the credit side.

B) Debits decrease asset and expense accounts, and increase liability, equity, and revenue accounts.

C) The left side of a T-account is the debit side.

D) Credits increase asset and expense accounts, and decrease liability, equity, and revenue accounts.

E) The total amount debited need not equal the total amount credited for a particular transaction.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

At the beginning of January of the current year, Sorrel Co.'s ledger reflected a normal balance of $52,000 for accounts receivable. During January, the company collected $14,800 from customers on account and provided additional services to customers on account totaling $12,500. Additionally, during January one customer paid Mikey $5,000 for services to be provided in the future. At the end of January, the balance in the accounts receivable account should be:

A) $54,700.

B) $49,700.

C) $2,300.

D) $54,300.

E) $49,300.

G) C) and E)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Identify the statement below that is incorrect.

A) The normal balance of accounts receivable is a debit.

B) The normal balance of dividends is a debit.

C) The normal balance of unearned revenues is a credit.

D) The normal balance of an expense account is a credit.

E) The normal balance of the common stock account is a credit.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 251

Related Exams