A) $56,000

B) $64,000

C) $76,000

D) $132,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

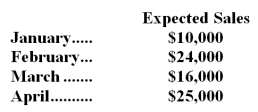

Justin's Plant Store,a retailer,started operations on January 1.On that date,the only assets were $16,000 in cash and $3,500 in merchandise inventory.For purposes of budget preparation,assume that the company's cost of goods sold is 60% of sales.Expected sales for the first four months appear below.

The company desires that the merchandise inventory on hand at the end of each month be equal to 50% of the next month's merchandise sales (stated at cost) .All purchases of merchandise inventory must be paid in the month of purchase.Sixty percent of all sales should be for cash;the balance will be on credit.Seventy-five percent of the credit sales should be collected in the month following the month of sale,with the balance collected in the following month.Variable selling and administrative expenses should be 10% of sales and fixed expenses (all depreciation) should be $3,000 per month.Cash payments for the variable selling and administrative expenses are made during the month the expenses are incurred.

-In a budgeted income statement for the month of February,net income would be:

-In a budgeted income statement for the month of February,net income would be:

A) $9,000

B) $1,800

C) $0

D) $4,200

F) B) and C)

Correct Answer

verified

D

Correct Answer

verified

Multiple Choice

The Culver Company is preparing its Manufacturing Overhead Budget for the third quarter of the year.Budgeted variable factory overhead is $3.00 per unit produced;budgeted fixed factory overhead is $75,000 per month,with $16,000 of this amount being factory depreciation. -If the budgeted production for July is 6,000 units,then the total budgeted factory overhead for July is:

A) $77,000

B) $82,000

C) $85,000

D) $93,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

LDG Corporation makes and sells a product called Product WZ.Each unit of Product WZ requires 2.0 hours of direct labor at the rate of $10.50 per direct labor-hour.Management would like you to prepare a Direct Labor Budget for June. -The company plans to sell 22,000 units of Product WZ in June.The finished goods inventories on June 1 and June 30 are budgeted to be 100 and 400 units,respectively.Budgeted direct labor costs for June would be:

A) $234,150

B) $468,300

C) $462,000

D) $455,700

F) A) and C)

Correct Answer

verified

Correct Answer

verified

True/False

In companies that have "no lay-off" policies,the total direct labor cost for a budget period is computed by multiplying the total direct labor hours needed to make the budgeted output of completed units by the direct labor wage rate.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The excess or deficiency of cash available over disbursements on the cash budget is calculated as follows:

A) The beginning balance less the expected cash receipts less the expected cash disbursements.

B) The cash available less the expected cash receipts plus the expected cash disbursements.

C) The beginning balance plus the expected cash receipts less the expected cash disbursements.

D) None of the above.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

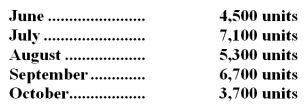

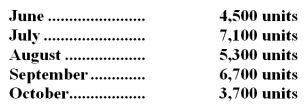

Roberts Enterprises has budgeted sales in units for the next five months as follows:

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units.The inventory on May 31 contained 410 units.The company needs to prepare a production budget for the second quarter of the year.

-The total number of units to be produced in July is:

-The total number of units to be produced in July is:

A) 7,630 units

B) 7,100 units

C) 6,920 units

D) 7,280 units

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

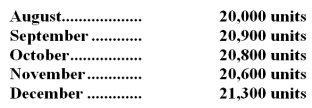

Castil Corporation makes and sells a product called a Miniwarp.One Miniwarp requires 2.5 kilograms of the raw material Jurislon.Budgeted production of Miniwarps for the next five months is as follows:

The company wants to maintain monthly ending inventories of Jurislon equal to 20% of the following month's production needs.On July 31,this requirement was not met since only 9,700 kilograms of Jurislon were on hand.The cost of Jurislon is $5.00 per kilogram.The company wants to prepare a Direct Materials Purchase Budget for the next five months.

-The desired ending inventory of Jurislon for the month of September is:

-The desired ending inventory of Jurislon for the month of September is:

A) $20,900

B) $52,000

C) $52,250

D) $20,800

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Fairmont Inc.uses an accounting system that charges costs to the manager who has been delegated the authority to make decisions concerning the costs.For example,if the sales manager accepts a rush order that will result in higher than normal manufacturing costs,these additional costs are charged to the sales manager because the authority to accept or decline the rush order was given to the sales manager.This type of accounting system is known as:

A) responsibility accounting.

B) contribution accounting.

C) absorption accounting.

D) operational budgeting.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Essay

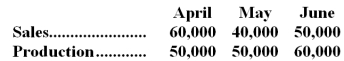

Carter Company has projected sales and production in units for the second quarter of next year as follows:

Required:

a.Cash production costs are budgeted at $6 per unit produced.Of these production costs,40% are paid in the month in which they are incurred and the balance in the following month.Selling and administrative expenses (all of which are paid in cash) amount to $120,000 per month.The accounts payable balance on March 31 totals $192,000,all of which will be paid in April.Prepare a schedule for each month showing budgeted cash disbursements for Carter Company.

b.Assume that all units will be sold on account for $15 each.Cash collections from sales are budgeted at 60% in the month of sale,30% in the month following the month of sale,and the remaining 10% in the second month following the month of sale.Accounts receivable on March 31 totaled $510,000 $(90,000 from February's sales and the remainder from March).Prepare a schedule for each month showing budgeted cash receipts for Carter Company.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

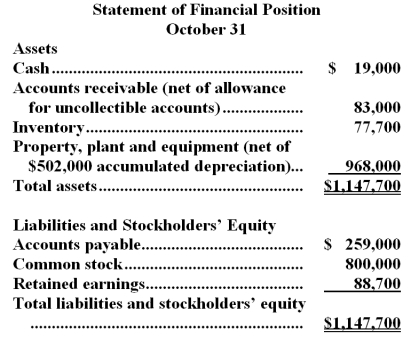

Carner Lumber sells lumber and general building supplies to building contractors in a medium-sized town in Montana.Data regarding the store's operations follow:

Sales are budgeted at $370,000 for November,$360,000 for December,and $340,000 for January.

Collections are expected to be 85% in the month of sale,13% in the month following the sale,and 2% uncollectible.

The cost of goods sold is 70% of sales.

The company purchases 30% of its merchandise in the month prior to the month of sale and 70% in the month of sale.Payment for merchandise is made in the month following the purchase.

Other monthly expenses to be paid in cash are $24,600.

Monthly depreciation is $17,000.

Ignore taxes.

-Accounts payable at the end of December would be:

-Accounts payable at the end of December would be:

A) $176,400

B) $252,000

C) $247,800

D) $71,400

F) B) and C)

Correct Answer

verified

C

Correct Answer

verified

Multiple Choice

The cash balance at the end of December would be:

A) $40,100

B) $28,000

C) $12,100

D) $40,800

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Roberts Enterprises has budgeted sales in units for the next five months as follows:

Past experience has shown that the ending inventory for each month must be equal to 10% of the next month's sales in units.The inventory on May 31 contained 410 units.The company needs to prepare a production budget for the second quarter of the year.

-The desired ending inventory for August is:

-The desired ending inventory for August is:

A) 530 units

B) 670 units

C) 710 units

D) 370 units

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Essay

Gokey Inc.bases its manufacturing overhead budget on budgeted direct labor-hours.The variable overhead rate is $5.10 per direct labor-hour.The company's budgeted fixed manufacturing overhead is $78,840 per month,which includes depreciation of $20,520.All other fixed manufacturing overhead costs represent current cash flows.The November direct labor budget indicates that 5,400 direct labor-hours will be required in that month. Required: a.Determine the cash disbursement for manufacturing overhead for November. b.Determine the predetermined overhead rate for November.

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Adams Company,a merchandising firm,has budgeted its activity for November according to the following information: Sales at $450,000,all for cash Merchandise inventory on October 31 was $200,000. The cash balance November 1 was $18,000. Selling and administrative expenses are budgeted at $60,000 for November and are paid for in cash. Budgeted depreciation for November is $25,000. The planned merchandise inventory on November 30 is $230,000. The cost of goods sold is 70% of the selling price. All purchases are paid for in cash. -The budgeted cash disbursements for November are:

A) $345,000

B) $375,000

C) $530,000

D) $405,000

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The manufacturing overhead budget at Ferrucci Corporation is based on budgeted direct labor-hours.The direct labor budget indicates that 1,600 direct labor-hours will be required in December.The variable overhead rate is $4.40 per direct labor-hour.The company's budgeted fixed manufacturing overhead is $25,120 per month,which includes depreciation of $5,440.All other fixed manufacturing overhead costs represent current cash flows.The December cash disbursements for manufacturing overhead on the manufacturing overhead budget should be:

A) $7,040

B) $19,680

C) $26,720

D) $32,160

F) None of the above

Correct Answer

verified

C

Correct Answer

verified

True/False

In the merchandise purchases budget,the required purchases (in units) for a period can be determined by subtracting the beginning merchandise inventory (in units) from the budgeted sales (in units).

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Crose Inc.is working on its cash budget for November.The budgeted beginning cash balance is $22,000.Budgeted cash receipts total $118,000 and budgeted cash disbursements total $116,000.The desired ending cash balance is $40,000. -The excess (deficiency) of cash available over disbursements for November will be:

A) $2,000

B) $20,000

C) $24,000

D) $140,000

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Stacy Company makes and sells a single product,Product R.Budgeted sales for April are $300,000.Gross Margin is budgeted at 30% of sales dollars.If the net income for April is budgeted at $40,000,the budgeted selling and administrative expenses are:

A) $133,333

B) $50,000

C) $102,000

D) $78,000

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The Charade Company is preparing its Manufacturing Overhead budget for the fourth quarter of the year.The budgeted variable factory overhead is $5.00 per direct labor-hour;the budgeted fixed factory overhead is $75,000 per month,of which $15,000 is factory depreciation. -If the budgeted cash disbursements for factory overhead for December total $105,000,then the budgeted direct labor-hours for December must be:

A) 6,000 hours

B) 21,000 hours

C) 9,000 hours

D) 3,000 hours

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Showing 1 - 20 of 144

Related Exams