B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Gross income includes

A) all income from whatever source derived unless excluded by law

B) excluded income

C) deferred income

D) all realized income

E) All of these

G) None of the above

Correct Answer

verified

Correct Answer

verified

True/False

Community property laws dictate that income earned by one spouse is treated as though it was earned equally by both spouses.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Karl works at Moe's grocery.This year Karl was paid $43,000 in salary but he was allowed to purchase his groceries at 10% below Moe's cost.This year Karl spent $3,600 to purchase groceries costing Moe $4,000 and worth $6,000.What amount must Karl include in his gross income?

A) $46,600

B) $47,000

C) $49,000

D) $43,400

E) $45,500

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Excluded income will never be subject to the federal income tax.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

NeNe is an accountant who works for a multinational firm this year and spent the entire year working overseas.NeNe's employer paid $40,000 of her overseas housing expenses this year.What amount of the $40,000 housing payments may NeNe exclude?

A) NeNe can exclude all of the housing payment because she worked more than 330 days overseas

B) 15,616

C) 24,384

D) 13,664

E) None of her salary can be excluded from gross income because NeNe must reside overseas for two consecutive years to receive an exclusion.

G) B) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Rental income generated by a partnership is reported by partners as dividend income.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

Barter clubs are an effective means of avoiding realization for tax purposes.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a true statement about the first payment received from a purchased annuity?

A) The payment is included in gross income.

B) A portion of the payment is a return of capital.

C) The payment can only be taxed in the year after the annuity was purchased.

D) The payment is not taxed until the annuity payments cease altogether.

E) All of these

G) C) and E)

Correct Answer

verified

Correct Answer

verified

True/False

Recognized income may be in the form of cash or property received (but not services received) .

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Which of the following is a description of how the annuity exclusion ratio is calculated for an annuity paid over a fixed period?

A) The expected return is divided by the number of payments.

B) The original investment is divided by the prevailing interest rate.

C) The original investment is divided by the number of payments.

D) The expected return is divided by the prevailing interest rate.

E) None of these

G) A) and E)

Correct Answer

verified

Correct Answer

verified

True/False

The tax law includes a complex set of restrictions called the anti-frontloading rules to make it difficult for taxpayers to disguise property payments as alimony payments.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

This year,Fred and Wilma sold their home (sales price $750,000;cost $200,000) .All closing costs were paid by the buyer.Fred and Wilma owned and lived in their home for 20 years.How much of the gain is included in gross income?

A) $550,000

B) $300,000

C) $250,000

D) $50,000

E) None

G) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Rhett made his annual gambling trip to Uwin Casino.On this trip Rhett won $250 at the slots and $1,200 at poker.Also this year,Rhett made several trips to the race track,but he lost $700 on his various wagers.What amount must Rhett include in his gross income?

A) $1,450

B) $1,200

C) $750

D) $250

E) Zero - gambling winnings are not included in gross income

G) A) and D)

Correct Answer

verified

Correct Answer

verified

True/False

Brad was disabled for part of the year and he received $11,500 of benefits from a disability plan purchased by Brad's employer.Brad must include all $11,500 of benefits in his gross income because Brad was not taxed on the disability insurance premiums paid by his employer.

B) False

Correct Answer

verified

Correct Answer

verified

True/False

The tax benefit rule applies when a taxpayer refunds amounts that were previously included in income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

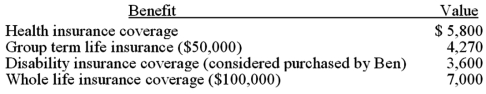

Ben's employer offers employees the following benefits.What amount must Ben include in his gross income?

A) $9,400

B) $11,070

C) $10,600

D) $7,000

E) Zero - none of these benefits is included in gross income

G) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Sally is a cash basis taxpayer and a member of the Valley Barter club.This year Sally provided 100 hours of sewing services to the barter club in exchange for two football playoff tickets.Which of the following is a true statement?

A) Sally need not recognize any gross income unless she sells the football tickets.

B) Sally's exchange does not result in taxable income.

C) Sally is taxed on the value of the football tickets even if she cannot attend the game.

D) Sally is taxed on the value of her sewing services only if she is a professional seamstress.

E) All of these are truE.Gross income includes the value of property received in exchange for services.

G) B) and C)

Correct Answer

verified

Correct Answer

verified

True/False

A portion of each payment from a purchased annuity represents income.

B) False

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Ethan competed in the annual Austin Marathon this year and won a $25,000 prize for fastest wheelchair entrant.Ethan indicated that he would transfer the prize to the local hospital.How much of the prize should Hal include in his gross income?

A) $25,000

B) $25,000 because all prizes are taxable

C) Zero because prizes transferred to charities are excludible

D) Zero because all prizes are excludible

E) Zero because prizes from charities are excludible

G) A) and B)

Correct Answer

verified

Correct Answer

verified

Showing 41 - 60 of 104

Related Exams