A) $1.50.

B) $2.

C) $4.50.

D) $9.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Kim is paid $50,000 per year, and pays an annual income tax of 10 percent. Due to an inflation rate of 10 percent, her pay increases to $55,000, which puts her in a higher tax bracket where she must pay 20 percent. Kim has experienced:

A) bracket costs.

B) the deflationary cost of tax distortion.

C) an increase in her purchasing power.

D) the inflationary cost of tax distortion.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When the price of a key input increases suddenly, it causes:

A) cost push inflation.

B) the business cycle to become sporadic.

C) demand pull inflation.

D) the velocity of money to rise.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

According to the quantity theory of money, an increase in the money supply leads to:

A) an increase in prices, as there are more dollar bills spent on the same number of goods and services.

B) an increase in prices, as there are the same dollar bills spent on a greater number of goods and services.

C) a decrease in prices, as there are more dollar bills spent on the same number of goods and services.

D) a decrease in price, as there are the same dollar bills spent on a greater number of goods and services.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When real rates of interest are negative, borrowers:

A) benefit, because the value of their debt declines.

B) suffer, because the value of their debt declines.

C) benefit, because the value of their debt increases.

D) suffer, because the value of their debt increases.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real rate of return is 2 percent, and the inflation rate is 0 percent, then the nominal interest rate must be:

A) 2 percent.

B) 0 percent.

C) 4 percent.

D) −2 percent.

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Why is deflation such a problem?

A) It increases the value of debt, making it harder to pay it back.

B) It decreases the value of debt, making it harder to pay it back.

C) It increases the value of debt, making it easier to pay it back.

D) It decreases the value of debt, making it easier to pay it back.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If an economy produces 3,000 units of output with a price level of $2 and the money supply (M) is $2,000, velocity is:

A) 2.

B) 3.

C) 67.

D) 150.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The classical theory of inflation:

A) describes a long-run equilibrium.

B) explains the direct relationship between money supply and the price level.

C) shows neutrality of money in the long run.

D) All of these statements are true.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In order to calculate the real interest rate, simply:

A) add the rate of inflation to the nominal interest rate.

B) subtract the rate of inflation from the nominal interest rate.

C) subtract the nominal interest rate from the rate of inflation.

D) divide the nominal interest earned by the rate of inflation.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The nominal interest rate is:

A) the everyday notion of the interest rate adjusted for inflation.

B) the reported interest rate, adjusted for the effects of inflation.

C) the amount of interest the bank charges you for saving or pays you for borrowing.

D) the amount of interest the bank pays you for saving or charges you for borrowing.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the average price level increases 10 percent per year, and the velocity of money is 2, then the:

A) inflation rate is 10 percent.

B) inflation rate is 5 percent.

C) inflation rate is 2 percent.

D) inflation rate is 20 percent.

F) None of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

The reduction in aggregate demand caused by deflation:

A) further reduces prices, causing a deflationary spiral.

B) will decrease production and increase prices, causing inflation to adjust the price level.

C) further reduces prices, causing aggregate supply to shift left back to long-run equilibrium.

D) will decrease production and increase prices, causing a deflationary trap.

F) A) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an economy is experiencing a negative output gap, there is:

A) inflationary pressure due to low demand.

B) inflationary pressure due to high demand.

C) significant inflationary pressure due to low demand.

D) significant inflationary pressure due to high demand.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

Price indexes allow us to convert __________ measures of output into _________ measures of output, because an increase in that would mean economic growth.

A) nominal; real

B) real; nominal

C) perceived; real

D) nominal; perceived

F) All of the above

Correct Answer

verified

Correct Answer

verified

Multiple Choice

If the real rate of return is 0 percent, and the inflation rate is 3 percent, then the nominal interest rate must be:

A) 0 percent.

B) 3 percent.

C) −3 percent.

D) 6 percent.

F) A) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

One of the costs associated with predictable inflation is:

A) tax distortions.

B) budget charges.

C) overheads.

D) the re-distribution of purchasing power.

F) C) and D)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

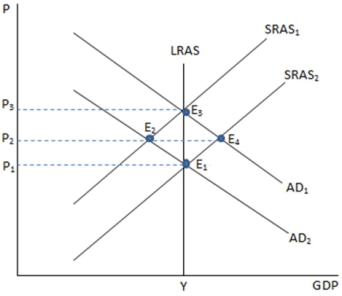

According to the graph shown, what does Y on the x-axis stand for?

According to the graph shown, what does Y on the x-axis stand for?

A) Full employment level of output

B) Current level of GDP

C) Observed level of output

D) Future target goal for output

F) B) and C)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

When an economy experiences deflation, consumption will:

A) decrease, because people will want to wait for prices to drop before spending.

B) increase, because people will want to wait for prices to drop before spending.

C) decrease, because people will lose value in their savings.

D) increase, because people will lose value in their savings.

F) A) and B)

Correct Answer

verified

Correct Answer

verified

Multiple Choice

In the long run, an increase in the aggregate price level:

A) doesn't change real output.

B) decreases real output.

C) increases real output.

D) increases spending.

F) All of the above

Correct Answer

verified

Correct Answer

verified

Showing 81 - 100 of 162

Related Exams